🛢️ **A New Era in Oil Demand**

In 2024, the outlook for oil demand has taken a dramatic turn. Despite earlier concerns of weakened consumption due to economic slowdown, indications now suggest that demand will surpass supply, leading to a scarcity of the energy resource and driving prices upward. The resilience of the US economy, alongside others like India, is spearheading this bullish trend. Unexpected factors such as new trade routes bypassing the Red Sea are further contributing to delaying the projected demand peak for crude oil.

**#OilDemand #EconomicTrends #GlobalEnergy**

📈 **Persistent Growth in Demand**

The million-dollar question in the oil market remains: when will we reach the peak in fossil fuel consumption? For years, speculation has abounded regarding this peak, yet demand has continued to climb, reaching historic highs time and again. In 2023, demand surged to around 101.1 million barrels per day, according to the International Energy Agency (IEA), with a further forecasted increase of 1.7 million barrels per day for the first quarter of 2024.

**#OilMarket #EnergyConsumption #IEAInsights**

⚖️ **Shifting Supply-Demand Dynamics**

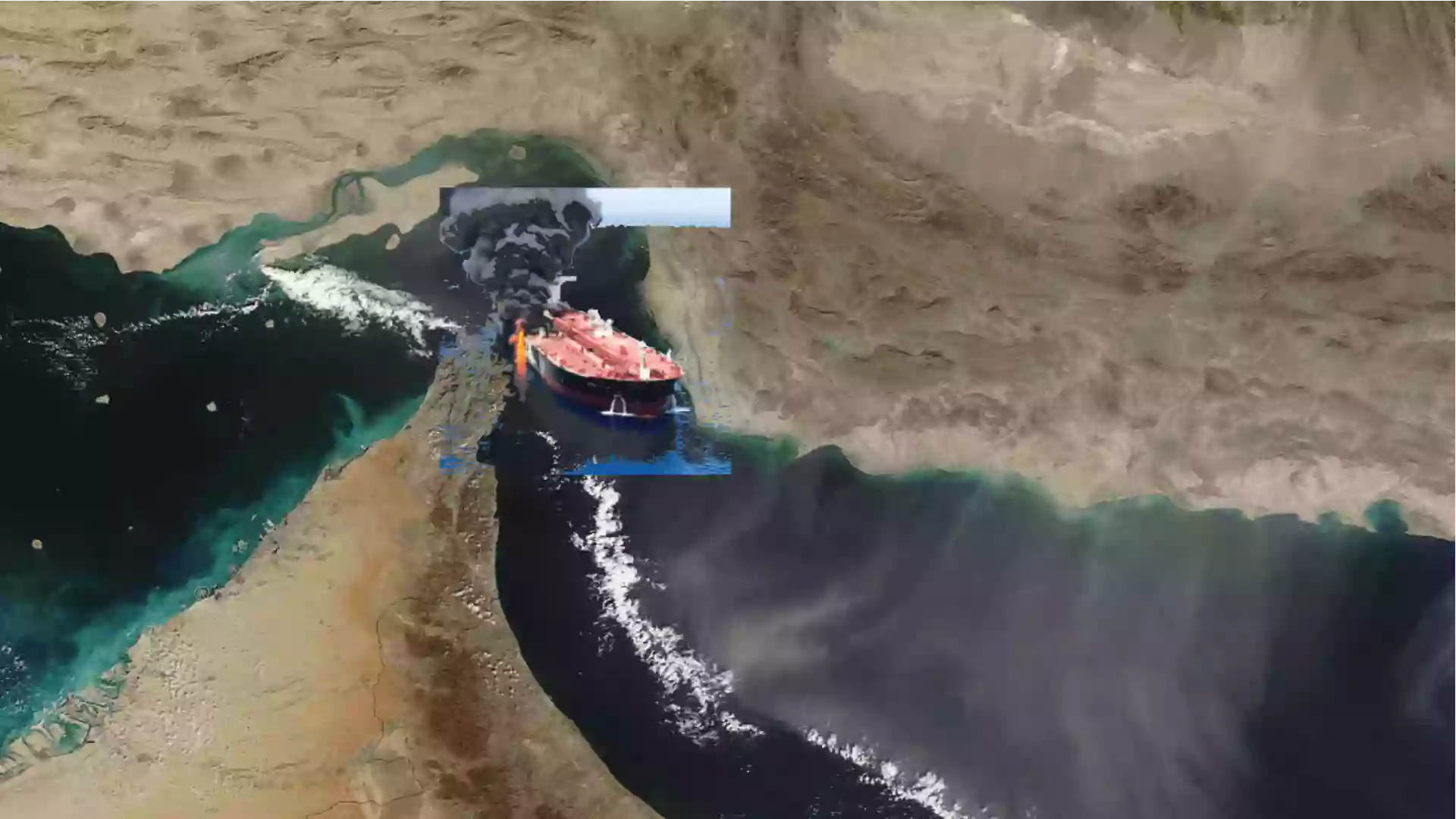

This upward revision in forecasts contrasts sharply with earlier expectations, suggesting a global oil market facing scarcity rather than the anticipated oversupply. This shift has propelled barrel prices, which have already seen a nearly 12% increase in 2024. The conflict in the Red Sea, necessitating new trade routes, adds another layer of complexity to the equation.

**#GlobalOilMarket #PriceTrends #SupplyChain**

🚢 **Impact on Maritime Trade**

The consumption of fuel by large transport vessels is staggering, with container ships alone consuming vast quantities of fuel daily. The establishment of new trade routes to circumvent the Red Sea, due to ongoing conflicts, has further increased global oil demand, contributing to delays in reaching the definitive peak in oil demand.

**#MaritimeTrade #OilConsumption #ShippingIndustry**

🌍 **Insights from Industry Leaders**

Recent industry events, such as the CERAWeek conference in Houston, Texas, underscore the strength of global oil demand. Industry leaders emphasize the need to invest in oil and gas resources in line with realistic demand forecasts, reflecting a continued confidence in the sector’s prospects.

**#EnergyIndustry #OilConference #GlobalOutlook**

🔍 **Analyst Perspectives**

Analysts project continued growth in oil demand, driven by factors such as the surprising strength of the US economy and robust growth in countries like India. Despite expectations of increased electric vehicle adoption, the dominance of internal combustion engines continues to support oil consumption globally.

**#MarketAnalysis #EnergyTrends #BloombergInsights**

📈 **Looking Ahead**

As we navigate the evolving landscape of oil demand, it’s clear that the market is experiencing unprecedented shifts. Stay updated on the latest developments and insights as we continue to monitor the trajectory of global oil demand in 2024 and beyond.

**#OilIndustryUpdates #EnergyMarket #GlobalEconomy**

Follow us on A New Era in Oil Demand for more insights and analysis.

**#FollowUs #OilDemandAnalysis #EnergyInsights**