The Surge in Middle East Risk Sparks $100 Oil Fear.

Despite Iran’s attack on Israel over the weekend, oil prices fell on Monday, as an Iranian response to the Israeli strike on the Iranian diplomatic mission in Syria was largely anticipated.

The well-telegraphed Iranian drone attack on Israel may have been a maximum escalation for now, analysts and investment banks say.

However, uncertainty about a potential Israeli retaliation and whether restraint will prevail continues to keep the oil market on edge. Risk premiums and fear will continue to price into Brent Crude in the foreseeable future.

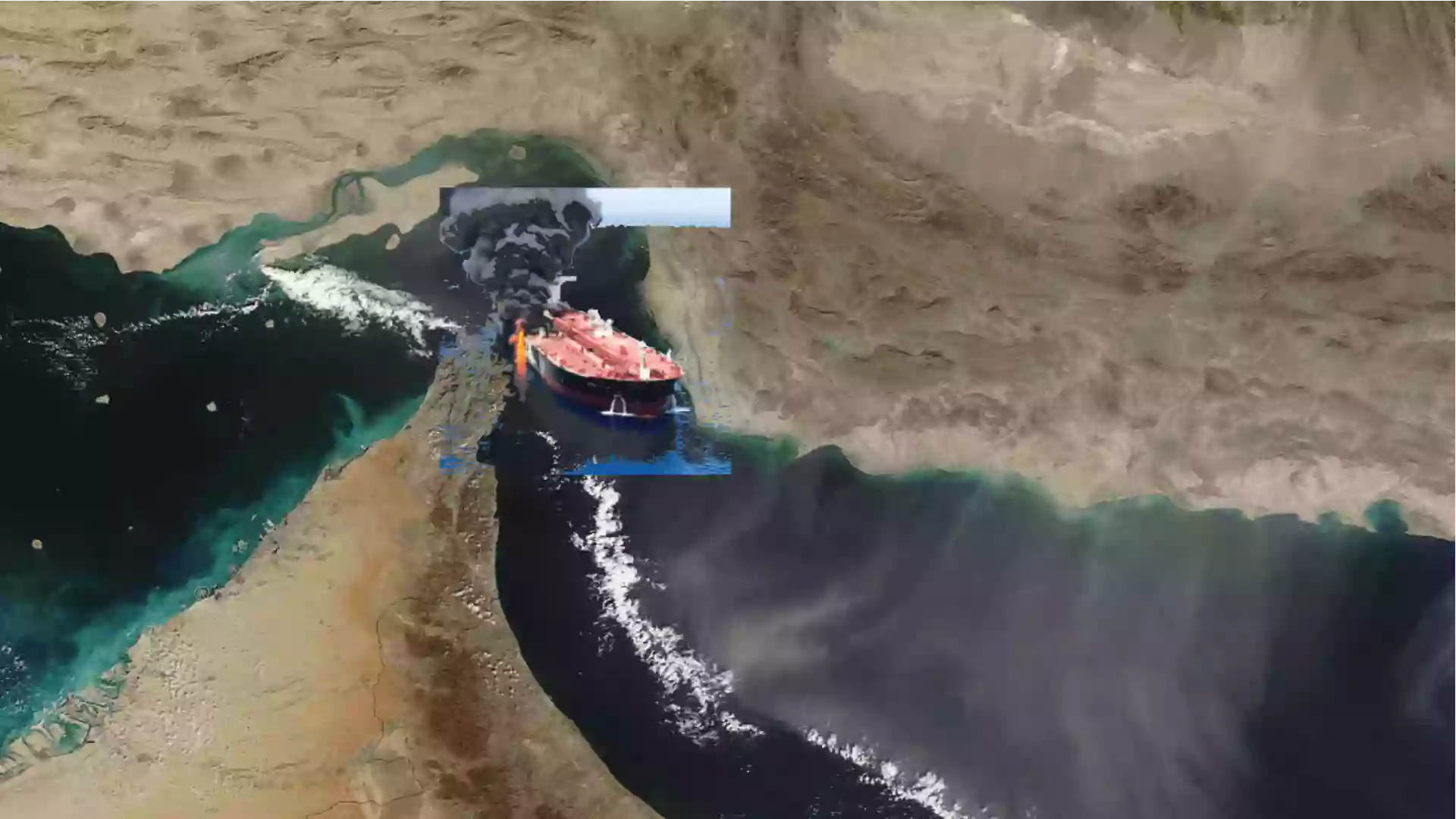

Uncertainty and risks have escalated in the Middle East, a key oil-producing region that is also home to the world’s most important oil chokepoint, the Strait of Hormuz. Around 21 million barrels per day (bpd), or one-fifth of the world’s daily consumption, are transported out of major Middle Eastern exporters through the Strait of Hormuz.

“Above $100”

In the event of further escalation, $100 oil is possible, analysts say, especially if it involves direct threats to oil supply.

“What is not priced into the current market, in our view, is a possible continuation of direct conflict between Iran and Israel, which we estimate could see oil prices trade up to +$100/bbl, depending on the nature of events,” Citigroup noted in a report, as reported by Bloomberg.

The worst-case scenario for oil supply is if Iran attempts to disrupt tanker traffic in the Strait of Hormuz, which could send oil prices soaring to $130 per barrel, according to Lipow Oil Associates.

Related: China’s Crude Oil Imports Hit Record High in 2023

“Any attack on oil production or export facilities in Iran would bring Brent crude oil prices to $100, and the closure of the Strait of Hormuz would lead to prices in the range of $120 to $130,” said Andy Lipow, president of Lipow Oil Associates, to CNBC.

An escalation involving the U.S. could push oil to $140 per barrel, according to Societe Generale, which has increased its Brent price forecast by $10 per barrel to reflect ongoing geopolitical risk premiums.

Escalation Not the Base Case

While warning that oil prices could soar well above $100 per barrel in the event of a major escalation, investment banks do not consider such escalation to be the base case.

While Israel weighs its response to the Iranian attack, the G7 has called for moderation, and the United States has indicated it would not be part of any Israeli offensive against Iran.

U.S. President Joe Biden has assured Israeli Prime Minister Benjamin Netanyahu that the U.S. commitment to defending Israel is “rock solid,” but that the U.S. would not participate in an offensive against Iran, a senior administration official told NBC News.

Early Tuesday, Israel was still weighing its options.

Iran has indicated that with the drone strike against Israel, it considers the matter closed, said Iran’s permanent mission to the United Nations on Sunday, but added that “if the Israeli regime makes another mistake, Iran’s response will be considerably harsher. It is a conflict between Iran and the rogue Israeli regime, from which the U.S. MUST STAY AWAY!”

Given calls for Israel to exercise restraint, “the most likely path from here (will be) de-escalation rather than further escalation,” said Richard Bronze, co-founder and analyst at Energy Aspects, to CNN.

“While Israel’s allies are pushing for a diplomatic response, it appears for now that Israel is considering a more direct response. If this is the case, unfortunately, it means that this uncertainty and tension will persist for quite some time, as markets focus on how Iran further retaliates,” wrote ING strategists Warren Patterson and Ewa Manthey in a Tuesday note.

Iranian oil production is at greater risk and even a strong diplomatic response from Israel’s allies could significantly hit Iranian oil exports with stricter enforcement of oil sanctions,” say strategists, who see up to 1 million barrels per day (bpd) of Iranian oil off the market in such a scenario.

“The worst is over”

Morningstar sees “more downside risks than upside at this time,” wrote Stephen Ellis, an energy and utilities strategist at Morningstar on Monday.

“Iran’s broad public and private warning amid growing regional tensions means the attack has already been reflected in oil prices through a higher geopolitical risk premium.”

Most of the recent rise to $91 oil before the Iranian attack has been the result of geopolitical risks rather than supply risks, according to Morningstar, which points out that the OPEC+ group has ample spare capacity of around 5 million bpd, and likely more, some of which can return to the market if oil prices rise above $100.

“We expect more downside than upside risks at this time, and see greater potential to reach $75 by the end of 2024 versus a sustained move beyond $100 per barrel,” said Ellis from Morningstar.

Iran’s retaliations now may trigger profit-taking, and prices could ease, but this is not the end of risk premiums, consultancy FGE said in a note on Monday.

Despite pressure from allies on Israel to limit a possible response, further escalation is not entirely off the table, but FGE says, “Our base case is that the worst is over.”

FGE’s base case now is that OPEC+ decides to relax some production cuts starting in July.

Even with another up to 1 million bpd of OPEC+ production back in the market, Brent is still expected to average between $90 and $95 per barrel in the third quarter with ongoing political risk, the consultancy said.